By Yaromir Steiner

In my previous blog post, I outlined some of the discussions and debates taking place across the industry about how to evolve and adapt to a changing commercial development landscape—and a changing world.

While 2021 was generally stronger than some analysts and observers had predicted, it’s clear that the COVID disruption has accelerated the pace of change. In a retail world where a sizable percentage of traditional malls are on the way out, there are very real questions about what the future will look like.

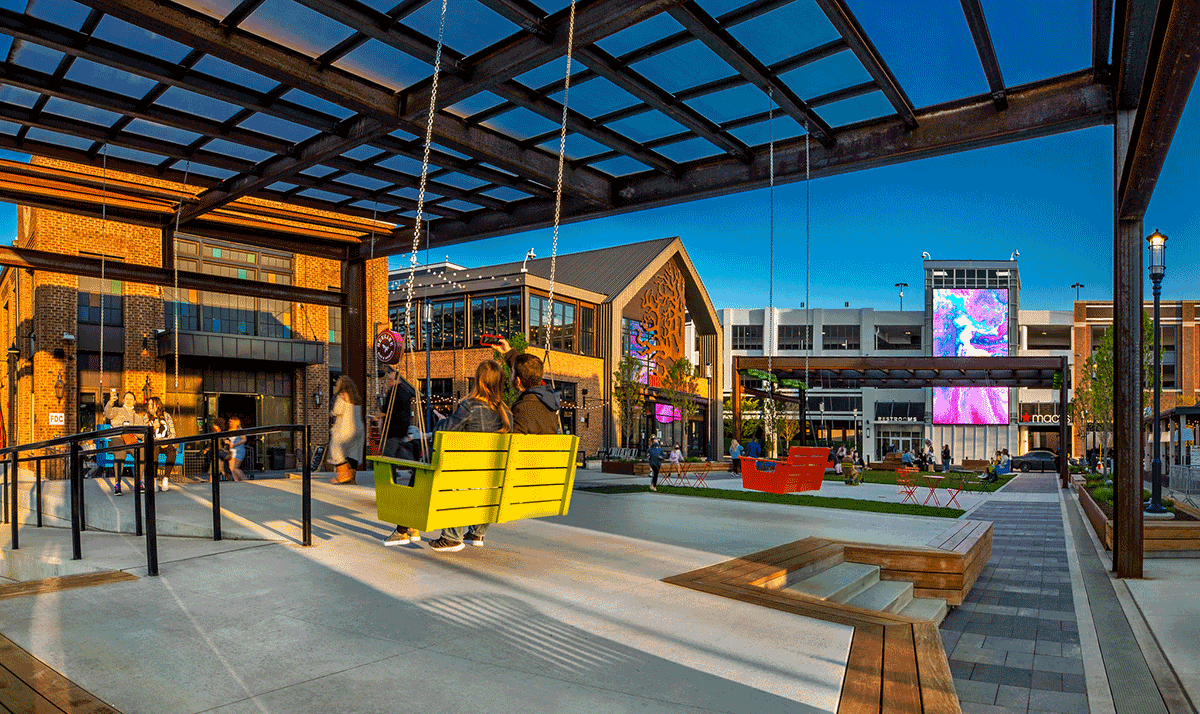

At Steiner, we are very fortunate that projects like Easton Town Center continue to thrive, selected by Chain Store Age as the nation’s top retail experience for two of the last three years.

Whether or not you have a leasing problem today—the thing that all owners and operators need to be thinking about is how to be relevant ten years from now. What will the post-COVID landscape look like: both the retail environments themselves, and the way they operate?

Let’s answer the first part of that question first, by talking about what won’t work. Only the best of the best traditional enclosed malls will survive, and I’m not especially optimistic about the future growth potential of outlet centers, either. The consensus is that smaller centers will become a necessary outlet for retailers looking to replace stores lost in traditional malls, but there are no easy answers about exactly what they will look like.

Demographic differences add a new layer of complication. It is incredibly difficult to create a smaller-scale retail or mixed-use asset that survives long periods. It’s not long before you’re catering to an aging customer base. Good examples are the Lifestyle Centers of fifteen years ago (Chico’s, Talbot’s, Ann Taylor, etc) that have mostly disappeared.

At large and diverse centers like Easton, you can continue to churn and evolve over time. However, there is inherently less flexibility in smaller centers. The lack of a true anchor presence makes those environments more vulnerable to shifting consumer sentiments and other evolving market dynamics.

The best retail environments can travel across generations, and that means more than a handful of tenants in a strip center. In that context, part of the solution might be expanding or modifying some of those existing environments to accommodate a wider range of retailers and retail spaces. I think the assets that look to be in the strongest position moving forward are grocery-anchored centers and power centers.

Those are the keystone features of developments that have the potential to be the durable and profitable retail and mixed-use environments of the future. Grocery-anchored assets combined with residential and other complementary uses is already a popular formula and is only likely to become more so going forward. The only caveat to that is that over the long term the grocery retail sector is perhaps most at risk of disruption due to robotization and AI.

Another area I’m intrigued by for the future is larger lifestyle centers. There will be space in many markets for scaled up versions of the Lifestyle Center model, perhaps with 16-20 specialty tenants instead of 8, combined with strong mix of dining and entertainment. These projects have the potential to occupy a sweet spot at the intersection of flexibility, experiential potential, and critical mass that could seamlessly fit into the hole left by shuttered malls.

The good news is that despite pandemic caution and the growing popularity of digital commerce, physical spaces remain important to younger consumers. The Baby Boomer generation was largely focused on the act of buying: the acquisition of goods. Millennials still value the ability to buy nice things of course, but experience matters more than ever.

Not just the experience of purchasing, but the something as seemingly utilitarian as the experience of opening the packaging (Apple has famously been on the cutting edge in that regard). There’s a reason why the term unboxing has grown in popularity in recent years. Retail brands, businesses, and environments will absolutely need to prioritize the consumer experience, through design, tenant choices, amenities and other means.

Coming up next, in the third and final installment of this look at what might be around the corner for retail, I’ll talk about some of the operational changes that are in store for the industry—and how those changes might impact commercial development trends and tactics.